Home » Investment Principles » Uncategorized » Rebalancing

Asset Allocation

October 29, 2018

Systematic Investing

October 29, 2018“……..Brokers often advise their clients to buy and hold. Focus on the average annual increases in stock prices, they say. Do not try to “time the market,” seeking the golden moment to buy or sell. What matters is the particular, not the average. Some of the most successful investors are those who did, in fact, get the timing right….. Suppose big news has inflated a stock price by 40 percent in a week, more than twice its normal volatility. What are the odds that, anytime soon, yet another 40 percent run will occur? Not impossible, of course, but certainly not large. A prudent investor would do as the Wall Street pros:

Take a profit

That rather long quote is from Benoit’s Mandelbrot’s excellent book, The (Mis)Behavior of Markets. Rebalancing in an important investment principle and one that is at the core of my portfolio management. The reason why is because investing is most difficult when you let your emotions rule in your decision making process. How many of us happily take profits from our winners and place that hard won capital into our “losers”?

Despite the emotional ickiness (yes it’s a word ‘cause I googled it) I rebalance regularly and I can tell you that even after managing money for a long time, it is emotionally painful to reduce a position if I am up 50% or more. And even more painful to put it into an underperforming investment. However, contrary to your ickiness (OK, I’ll stop using it now) studies show that rebalancing on a regular basis outperforms a buy and hold portfolio.

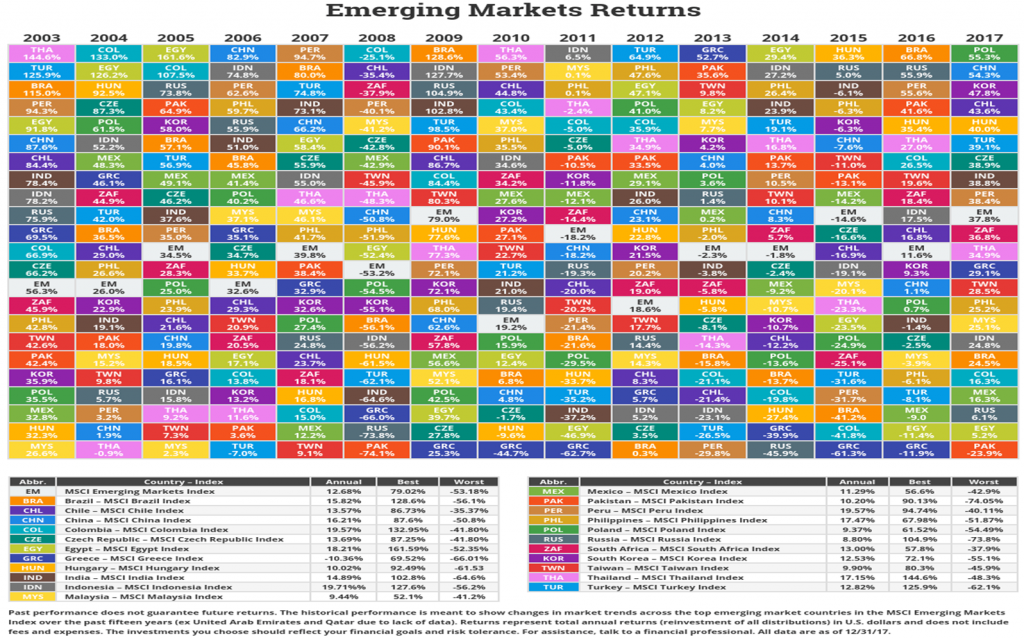

What a Turkey

Have a look at Turkey in the chart below to see why rebalancing is critical to investment success. Firstly, note the volatility of the returns which range from a high of 125.9% in 2003 (thus handing you dinner party bragging rights) to a gut wrenching loss of -62.1% in 2008. Now to be fair, everything got smashed in 2008, but strangely I never found much comfort knowing everybody else got smashed as well. But had you rebalanced after each “winning” year, from 2003 onward you would still have gotten smashed in 2008, but you would have pocketed some of the 125%, 42%, 56.9%, -7% and 74.8% profits beforehand. In addition to that, your total position in 2008 would have been reduced and therefore you would have “lost” less. In fact if you rebalanced methodically, you would most likely have still been in front even with the 2008 loss. Indeed, being the astute investor by understanding mean reversion, buy low, sell high you could have placed more in Turkey at the bottom of 2008, start of 2009, and nearly doubled your money again on the rebound.

This is not just cherry picking to prove a point. I am simply pointing out that because of mean reversion, you must take profits at the highs and put them back in at the lows – in other words, rebalance.

How to Rebalance

You can rebalance on a percentage basis or a time basis. I will usually rebalance on a profit/loss basis on individual investments, but I also consider the value of the overall market. You can rebalance on a monthly basis when you reassess your portfolio. But be sure to do as Mandelbrot says – take profits! You can then add to your underperformers if you wish, or you can hold cash. Don’t be afraid to hold cash. Because in the market ebbs and flows, you will have an opportunity to put that capital to work and compound your existing profits. Charlie Munger, Buffett’s sidekick relates a great story – as frustrating as it is…….

You have $10,000 and a choice – invest today and earn 7% for 10 years, or leave your money in cash earning 4% for 4 years and then invest in a stock and earn 10% for the next 6 years. Waiting patiently for that 10 percent opportunity yields dramatic results. After 10 years, you would have 16% more money – more than $1000 – if you simply sat on your cash for 4 years waiting for a great opportunity.

I know what you’re thinking. “OK I get it Steve, but how much do I take out or put in”. Here’s a simple method (but not the only method). If you do this with indexes such as the ASX300 you will succeed in generating greater returns than buy and hold over the longer term. Remember the market goes up roughly 70% of the time, so taking profits in the good times means more to invest in the down times.

Simply rebalance between stock value and cash. The idea is to maintain a specific level (which you’re comfortable with) between 2 assets. In this case let’s say cash and stock. So you buy $1000 worth of the ASX 300 and hold $1000 in cash – a 50/50 weighting. At the end of each month you simply rebalance back to 50/50 weighting. So if after a month, stock values is $1100 you sell $50 worth of stock. Now you have $1050 in stock and $1050 in cash. This may seem to be a lot of cash, but as I said you can adjust to your personal preference of 60% stocks, 40% cash or hold a 70/30% portfolio meaning, $1400 in stock and $600 in cash. Again simply rebalance to those percentage weighting and presto! A simple yet effective way to build wealth through rebalancing. Remember………..