ABOUT STEVE

Steve have been an investor for nearly 20 years, 11 full time.

Steve has a mix of private sector, public sector experience. Steve has worked in the private sector, had his own company, worked for the public sector, worked as a political advisor, and in late 2005 became a fulltime investor.

Steve holds a Bachelor of Science (Environmental) from Griffith University and a Masters of Applied Finance from Kaplan.

In early 2006, Steve started to invest full time and with plenty of time to devote to watching and studying stock markets, started reading all manner of books, articles and academic papers on various attributes of stock markets, human behavior, natural and social sciences.

Programs

One-on-One personal mentoring

With our personal mentoring program, Steve will provide you with the knowledge and principles that are required to manage your own stock market investments. The unique program includes a 2 hour one-one one presentation followed by ongoing monthly mentoring sessions (usually one hour) where Steve explains current events and guides you through the market cycle. [Read more]

Self Managed Super Fund Mentoring

Steve has his own SMSF. He can assist in outlining the costs and benefits of SMSF’s versus having others manage your investment. Steve can show you a range of options regrading how to maximize your SMSF investments. [Read more]

Retiree Planning

As a full time investor and age 55, Steve understand how important risk management is. As Warren Buffett says, rule No. 1 is to avoid losing money. Understanding stock market cycles and key signals is important to critical to avoid losing your hard earned wealth. [Read more]

Total Wealth Management

There are fewer things than money that to cause us such happiness, sadness, frustration and all the emotions in between. Very few of us are Robinson crusoe, where money is concerned. Sticking to a budget is tough these days, as social media and ads selling all types of things that will make us healthier. [Read more]

Mentoring Philosophy

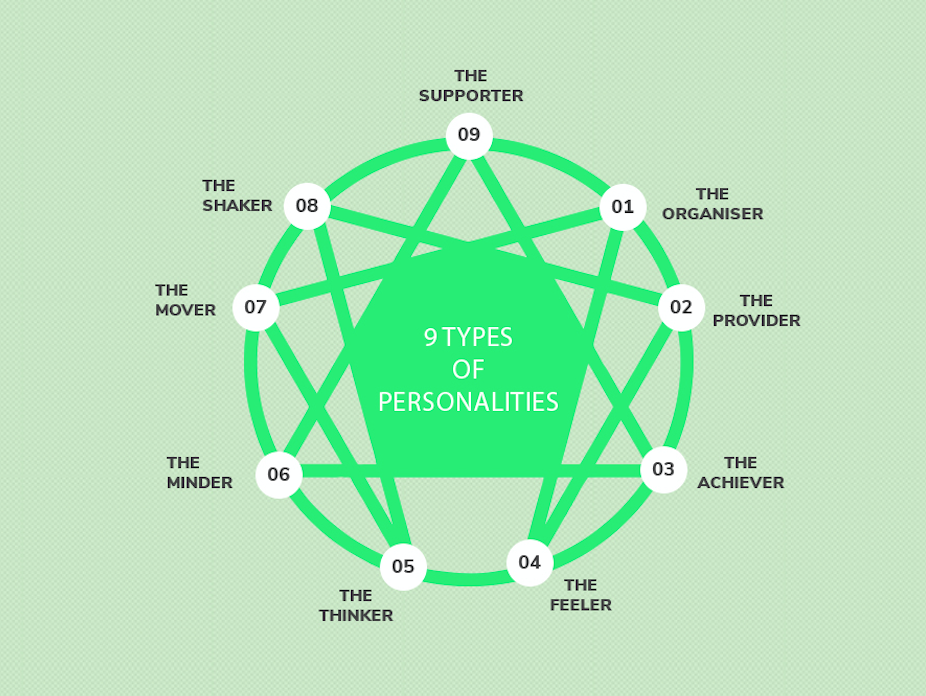

When it comes to investing, the dominant thought is that we are all sensible, coolly rational people and so no-one ever loses control of their emotions. This is singularly the most damaging belief when it comes to investing. The reality is that when it comes to money none of us are always rational.

It simply does not add up, that we can have a range of emotions, love, anger, sadness etc regarding a whole range of issues, but when it comes to money and investment, we all singularly take a rational approach. This is simply not true. Many of us, including those in the finance industry believe that once we understand the “facts” of the stock market we will be able to buy stocks when they fall and sell when they rise. It sounds very simple, but putting it into action is somewhat more difficult.

Billionaire Investor

Oliver Wendell Holmes

The Money Game (1968)