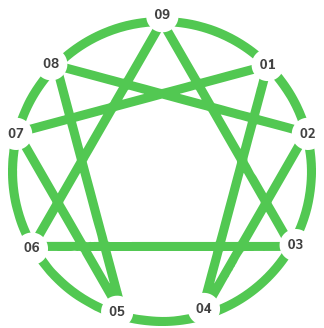

Home » The 9 Types

The

9 types

When it comes to investing, the dominant thought is that we are all sensible, coolly rational people and so no-one ever loses control of their emotions. This is singularly the most damaging belief when it comes to investing. The reality is that when it comes to money none of us are always rational.

It simply does not add up, that we can have a range of emotions, love, anger, sadness etc regarding a whole range of issues, but when it comes to money and investment, we all singularly take a rational approach. This is simply not true. Many of us, including those in the finance industry believe that once we understand the “facts” of the stock market we will be able to buy stocks when they fall and sell when they rise. It sounds very simple, but putting it into action is somewhat more difficult.

What stops us from doing this is our emotions. Any investment strategy that fails to account for an individuals’ beliefs and motivations will most likely fail. It is simply impossible to separate out our personality from investing. Our personality combined with media headlines, investment advice and general fear and greed at specific points conspire to make investing difficult.

“What might seem irrational from the outside does not seem irrational from the inside” Margaret H. Smith

When it comes to money we all save, spend and invest for different reasons and all of us have specific beliefs about money. Some folks spend all their money on things they like, but may not necessarily need, some don’t think much of saving and also spend their money on their family or friends before themselves. Others still impulse spend when they feel stressed or as a “reward” for achieving their goal. At the opposite end of the spectrum some folks save as much as possible, even if they don’t know what they are exactly saving for, or some are disciplined enough to save in order to achieve a financial goal.

So we all possess strengths and weaknesses in our personalities which play a role when we invest. But as we each are somewhat different, I notice that when I explain some investing concepts and principles there is a wide range of reactions. Some people immediately understand the market cycles both at the head level and the intuitive level. Others, hold strengths in different areas such as diversification or risk management.

We all possess strengths and weaknesses in our personalities when we think about money and investments. It is simply impossible to separate out our money and investment beliefs.

Investment success relies heavily on knowing ourselves and how we prepare and react to changes in the stock market. Using the 9 Types as a guide, we will be able to identify specific patterns of your personality and investing habits. The 9 Types is able to show your automatic patterns and unconscious biases associated with your personality.

When combined with knowledge regarding the ebbs and flows of the stock market, understanding ourselves gives us an incredible advantage when it comes tosuccessful investing.

So take the test to find out what type of investor you are. Once you understand your type, you will be able to determine your strengths and weaknesses when it comes to investing.

Then we can set about utilising those strengths and weaknesses to develop an investment map for you.

So take the test to find out what type of investor you are. Once you understand your type, you will be able to determine your strengths and weaknesses when it comes to investing.

Then we can set about utilising those strengths and weaknesses to develop an investment map for you.

“The plan of betting only at the level that I was emotionally comfortable with and not advancing until I was ready enabled me to play me system with a calm and disciplined accuracy” Ed Thorp, Legendary Billionaire Investor and Author.

Understanding your sub-type refines the process by highlighting the subtle differences between individuals who will belong to the same type. Choosing the correct subtype is important. If we are a SX subtype, then we may well invest widely and sporadically because of the “excitement” attached to it. If an SP, then we most likely invest cautiously, starting small and working our way up.

We all have three major instincts (descriptions below). These are

To stay alive,be safe, secure and comfortable (Self Preservation)

Affiliate and connect with others (Social)

Have a family and deep relationships (One-on-One).

As with many of our decisions and beliefs they are not usually entirely conscious. That is, we tend to have patterns of unconscious beliefs and behaviour. It is also interesting to note that two of the three involve our interactions with others. This is particularly relevant because many investors make decisions based on what others are doing whether they are family members, friends or the general public.

Our dominant instinct is the one we put most of our focus and energy towards. We can sustain interest in this area and believe time here is well spent. It generates a feeling of self-reliance and confidence. It is how we tend to serve in our close relationships.

Our middle instinct is one we neither put too much weight on nor completely ignore. We tend to reference it when we are more relaxed, or as a way to support our dominant instinct. It is usually referenced as support or a relaxation.

The blindspot instinct is the one we put very little energy or focus on. Because we have no confidence here or control over what happens in this sphere we rely on others to help us address the issues of this area (investing is often a blindspot for many). We convince ourselves it is boring and not important to pay attention to this area.

Self Preservation (SP) - Dominant

When SP is our focus, we tend to believe that material resources help us survive. We tend to be very logical and analytical about what we need to survive. We become protective of our resources, our safety, our time, and don’t really want to “waste” these things. We generally prefer a stability and reliability in most things like our routines, and we seek a lifestyle where wecan enjoy ourselves and be comfortable. While we enjoy the company of others, in most decisions we’re quite happy to “go it alone”

Social Instinct (SO) - Dominant

The social instinct is about seeing our role focus on belonging to the group. Energy is focused on maintaining good relationships with the group and so we spend time bonding and connecting with others and fitting in. With money (or investing) we prefer to navigate by implicit social norms rather than direct and explicit enforcement of rules or regulations. We tend to focus some attention on the basics like personal needs, making money to cover expenses, and staying roughly within budget, if we are motivated by social responsibility for the family/group.

One-on-One Instinct - Dominant

The One-on-One instinct brings charge, electricity and intensity but also the possibility of boredom. You are focused on energy and so you have strong likes and dislikes. You want lights, camera, and action! If something bad happens, you can bounce back relatively easily and when the right opportunity strikes you are ready and willing to respond. You get strongly focused on what attracts you that nothing or no one can distract you. You will be open to new opportunities and willing to take big risks for potentially big rewards.