Home » Investment Principles » Uncategorized » Diversification

Systematic Investing

October 29, 2018

The Risk Hierarchy

October 29, 2018Diversification

Arguably, diversification is the number one principle that you will receive from an overwhelming majority of financial advisers or planners. Diversification has been promoted as a standard refrain for a long time as a way to reduce risk in a portfolio. The risk of putting all you funds in just one or two stocks is risker than putting it in one or two hundred. Hence diversification is the mantra, and so most investment portfolios look alike, made up of a residential property, some shares and a superannuation account (which is usually more weighted in stocks).

Another reason to diversify was according to the Efficient Market Hypothesis, you can’t beat the overall market and so the best approach was to simply buy the index and receive the market return. Trying to select companies that will outperform all the other was near nigh impossible, so don’t bother.

Buffett said that diversification is for folks who don’t know what they’re doing. He’s not rude, but simply stating that unless you want to spend a lot of time looking a company balance sheets and the “fundamentals” (I’ve had a life of it so wouldn’t recommend it) you should heed his advice – buy and index fund, sit back and collect the pot when you retire.

But the problem for many people is that they won’t have enough for retirement, and so you could be excused for asking if just buying an index fund (diversification) is the best approach or is there a potentially better way?

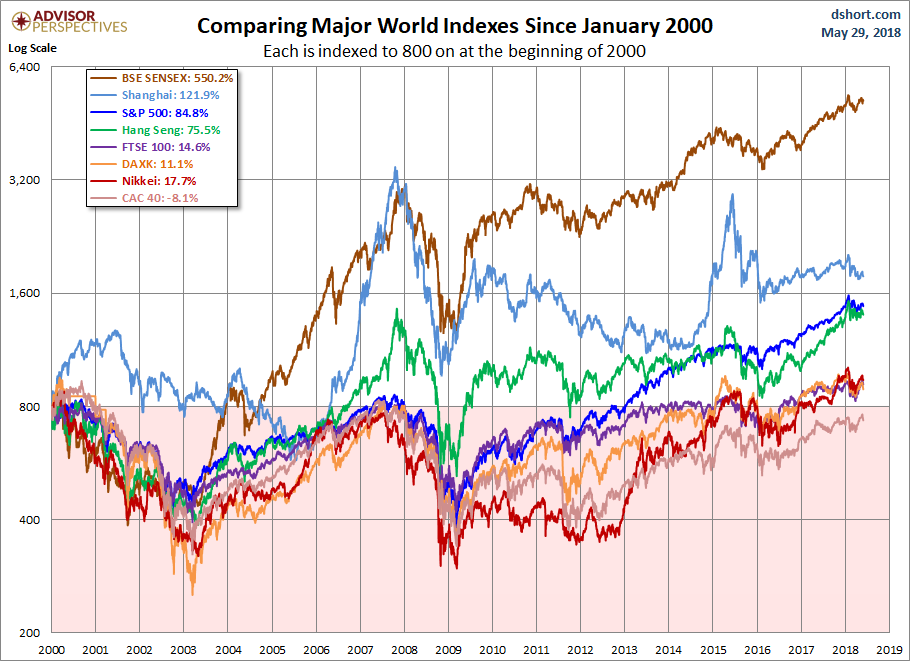

Since the 80’s there has been an increasing linkages between each country’s economy as they expand trade in goods and services As each country connects, their stock markets also starts to increase their correlation. If you look at the graph below, you see that most of the major markets move in some kind of sync. What varies is the level of returns.

Very often, all developed markets will move in unison but returns will vary. The US market may return a positive 12%, the ASX 25% and the UK 16%. For example, around 60% of the time when the US market rises or falls on any given trading day, the ASX usually goes in the same direction the next day. While the annual stock market returns may vary, the same applies to annual returns as well. Most years the US rises, so does the ASX.

Unlike previous generations, you can now invest in just about any asset class in any part of the world. So it’s worth asking if diversification across asset classes is still the best approach to wealth building. Maybe we can build wealth through a little bit of knowledge/specialisation and investing within an asset class. Now back to Buffett. Notice he didn’t say spread your funds across asset classes. He said most of us should just index as a way of diversifying. But for those who know what they’re doing (specialization through increasing one’s knowledge), diversifying within one asset class can build wealth. Buffett is living proof as his obsession with business and stock markets has made him extremely wealthy.

Buffett does not diversify. Most of his funds are in stocks and only a few stocks. He simply buys what’s cheap in the same asset class as a way to build wealth rather than diversify to the point where your returns are eaten away by the “need” to reduce risk through diversification. Think about it this way – your neighbor approaches you with an offer to buy their house at a very cheap price. You know with a high degree of confidence that you could buy and sell it quickly to make good profit. Or join it to your property and sell the 2 blocks together.

It would seem rather silly to say “thanks mate, but I’m really into diversification and since I already have a house, another one would increase my investment portfolio risk so I’ll pass”. Make sense?

What we are really talking about with diversification is how much knowledge you need to build wealth. Most of us specialise by going to university, getting a degree (specialist knowledge) and hitting the workforce looking for more income.

GOLDILOCK’S PORTFOLIO

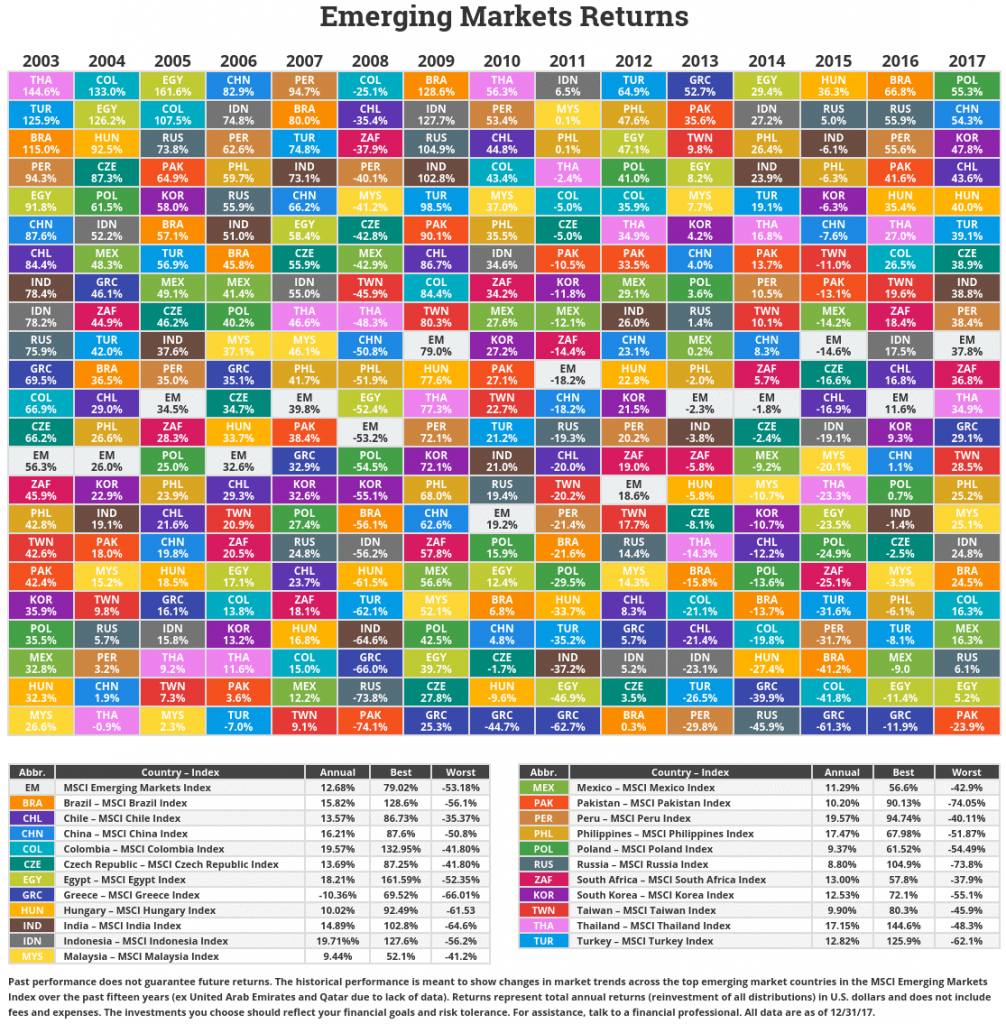

The Goldilock’s portfolio I think is for investors who don’t want to be completely passive in their investment approach – that is, maximizing diversification by simply buying an index like the ASX 300 and then just letting it go. This portfolio doesn’t require too much knowledge but gives you a degree of diversification using market indexes. Here’s our Emerging Markets Table again (you can use this with other asset classes such as sectors, developed countries and investment styles like value and growth).

Note, that if you put $1,000 into each sector in the chart, you would receive the average return – that is made up of the good ones, the bad ones and the ugly ones all combined. Now, an alternative would be to adjust the amount of funds (the weighting) between the sectors. Think of it as diversification in funds allocated rather than the range of asset classes you invest in.

If you have been reading my previous posts then you know, I would be recommending giving the bottom sector performers a little bit more weighting and letting mean reversion do its thing. Now this won’t result in outperforming every year, but I can almost guarantee this approach to diversification will allow you to outperform the market and build wealth just as safely as a diversified portfolio across a myriad of asset classes.